Cabinet committee expresses satisfaction over CPEC projects’ progress

ISLAMABAD, August 13 (APP): The Cabinet’s Committee on China Pakistan Economic Corridor (CPEC) on Thursday expressed its satisfaction over the progress of CPEC projects.

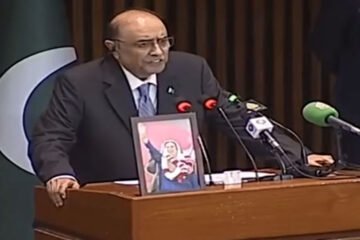

The committee met here with Minister for Planning, Development and Special Initiatives Asad Umar in the chair to review the progress of CPEC. The meeting was attended by ministers and secretaries from 10 ministries.

Special Assistant to the Prime Minister on Information and Broadcasting Lt Gen (retd) Asim Saleem Bajwa briefed the committee about the progress of various CPEC projects being executed across the country.

Asim Bajwa, who is also Chairman of the CPEC Authority, in a tweet said as per Prime Minister Imran Khan’s vision, it would be ensured that CPEC’s dividends would reach every Pakistani.

He said the officials from the relevant ministries reaffirmed their full commitment to accelerate work on CPEC projects.

Minister Asad Umar, in a series of tweets, said the cabinet’s committee reviewed progress of CPEC projects during the financial year 2019-20.

He said in the power sector, two projects with capacity of 1,980 MW were commissioned while ground breaking of another was done. Similarly, financial close of two projects was achieved and concession agreements of two hydel projects of 1,800 MW capacity were signed.

Moreover, two infrastructure projects were completed, with ground breaking of another one, while the Planning Ministry accorded approval for three other projects, he added.

“Most importantly the biggest CPEC project so far and the biggest rail project in history of Pakistan, ML-1 got approval from Executive Committee of National Economic Council (ECNEC) to proceed further,” Asad Umar said.

The minister said significant progress had been achieved in the development of Gwadar port city’s infrastructure, which was the linchpin of CPEC. It included ground breaking of Pak-China Hospital and a technical and vocational center.

Phase-1 of a project to supply 5 MGD water from Saur Dam to Gwadar city was also completed, he added.

Asad Umar mentioned that the ground-breaking of first CPEC Special Economic Zone (SEZ) in Faisalabad had taken place in January while significant progress was made for setting up SEZs in Dhabeji, Sindh and Rashakai, Khyber Pakhtunkhwa. “As we move forward the emphasis on industrial cooperation (with China) will increase.”

He said two areas of emphasis and priority in the next phase of CPEC would be agriculture, and science and technology. New joint working groups had been established for both the areas under the CPEC framework, Asad Umar added.

Stay tuned to Baaghi TV for latest news and updates!

Surely the Good Pakistanis will not the mistakes of the Hindoo Dindoo Indians and their disasters in exports and SEZs

India is doomed and the Indian SEZs are doomed.

• The pathetic state of the exports from the SEZ is assessed by the number of non-operative units and the poor capacity utilisation of the SEZ units – information about which is in public and national interest

• The laqck of planning of the GOI is highlighted by the fact that the GOI has done no benchmarking of the operations of the SEZ per se, and the SEZ units within – for each sector with comparable peers,in India or the global competition

• If a sector, say X,exists in a SEZ in a specific maritime geography and its global export hub,is in Country A, and the GOI has not been benchmarking the operating parameters of the Indian SEZ and the SEZ units of that sector (X),every 3 years – then the SEZ units in sector X,in India,will definitely cease to exist,or be in a state of terminal decline or exist at the mercy of competitors

• With the miserable performance of the Indian Rupee,and its impact of reduction in Dollarised Rupee costs payable to the SEZ authority by the SEZ units – why are the exports from the SEZs still a failure? In addition, in several sectors, the rupee costs paid by the SEZ units to the SEZ Authority,are not the determinant for operating and financial viability of the SEZ units

• In essence,the GOI has utterly failed to provide a level playing field to Indian exporters,in terms of admin costs,operating cost neutrality,financing costs,effective logistics costs and fiscal red tape and procedures

• The centres of manufacturing excellence near SEZs (For CMT/Job work/Material and Labour sourcing) are not cost effective – as there is no synergy between the SEZ and the Industrial planning and policy

• The strategy of the GOI is highlighted by the fact that the GOI has engaged no 3rd party to analyse the inefficiency of the operating parameters of SEZs and the SEZ units within the SEZ – for each sector within it , with comparable peers in India,and the global competition

• What planning and strategy will the GOI do,if it has no formal analysis of the specific operating costs,parameters,management and other issues,which explain the dismal state of the SEZ units by sector,scale and management quality

• The dismal state of the GOI planning is that it has not properly planned the sector profile of the units in each SEZ, to ensure that the right sectors are in the appropriate geography,in the right SEZ,to minimise the net logistics costs on the EXIM chain, and minimise the inward material logistics costs – considering the future dislocations in inward and external material sources and options of transhipment and alternative export markets

• Several SEZs elsewhere invest limited equity in SEZ units and common service providers,like banks,facilities,hotels,accounting firms etc,as a demonstration of their stake in the SEZ and their strategic inputs in the planning and operation of the same – which is then used to lower the lease charges – which is completely absent in India

• All of the above is to be seen in light of the fact that the SEZ has no data of the financial or operating performance of the SEZ units,loss making units or even the financial and operating performance of the Developers of the SEZ – and is naturally not concerned with the losses or the financial performance of the SEZ units therein

• The peculiar pattern of CMT and Job workers of key sectors such as Gold and Diamond jewellers,with multiple movement of stocks at different processors o/s the SEZ – is not the norm for Gems and Jewellery SEZs or SEZ units – and represents an abnormal industrial agglomeration with a planned and structural dislocation in manufacturing and processing operations – which cannot be solely for the purposes of manufacturing and commercial efficiency.

• Information on raids and prosecutions is critical especially in sectors with high import duties (on merit mode) for inputs,customised finished goods (wherein DRI/Customs cannot assess over invoicing),frequent movements to and from 3rd party processors (which makes the case for wastages and losses in SION and disappearing materials), materials where the EXIM transit time is a few hours and the logistics costs are less than 1per cent of CIF/FOB rates, inputs and outputs with marked differences in rates of different grades of items and offgrades,warehousing artificial losses,amortisable costs ,bad debts and write offs in select SEZs (to be used for 3rd party exports or mergers to obviate tax on SEZ profits),items where the SEZ units are well aware of the sampling and test checks of the DRI and Customs at the SEZ for the inputs and outputs etc.

• The Gems and Jewellery industry is run by cartels from a particular community spread from Western India to North America,EU,East Asia,West Asia and Africa and is a well coordinated money laundering and smuggling operation from the state of rough diamonds and raw gold,to the marketing of jewellery and warehousing of processed and raw diamonds,the banking chain,raters and the chain of associate and front companies – which is all the more insidious,as all the data with DRI/ED/Customs/Interpol used by the Indian State for surveillance all originated from the overseas counterparts and partners of the Indian traders located in India (who are in many cases – in spirit the same de facto entity owners)

• The premise that Indians are the least cost labour source for the jwellery sector and their informal working style (w/o documentation,using informal labour and in slum style conditions) is an innovative marvel of Indian genius,is a pathetic deception,and the entire array of fiscal and monetary sops for this sector (including SEZ) allows the sector to generate financial buffers via money laundering,tax arbitrage,treasury operations, merchanting exports,accomodation financing ,cash financing, alternative fund transfers,FX speculation,leveraging double and layered financing,defrauding Indian Merchant exporters such as STC and MMTC,Credit insurance fraud etc. which provide the sector a pricing edge in overseas markets ( via illegal,nefarious and fraudulent means)